What is the difference between Medicare and Medicare Advantage Plans?

Let's first take a look at what each is.

How Medicare Works:

In 1965 original Medicare was introduced, and it consisted of two parts. Part A covered inpatient hospital care, and Part B covered doctor visits. Although the list of covered services has expanded, the separation of benefits is still the same.

Everyone who enrolls in Medicare gets the same primary benefits regardless of whether they choose Original or Medicare Advantage. They include coverage for:

- Medically necessary services to diagnose and treat illnesses, injuries, and diseases

- Medical equipment and devices such as wheelchairs, oxygen, and prosthetics.

- Preventive care including screening tests, most vaccines and immunizations, and routine physical exams

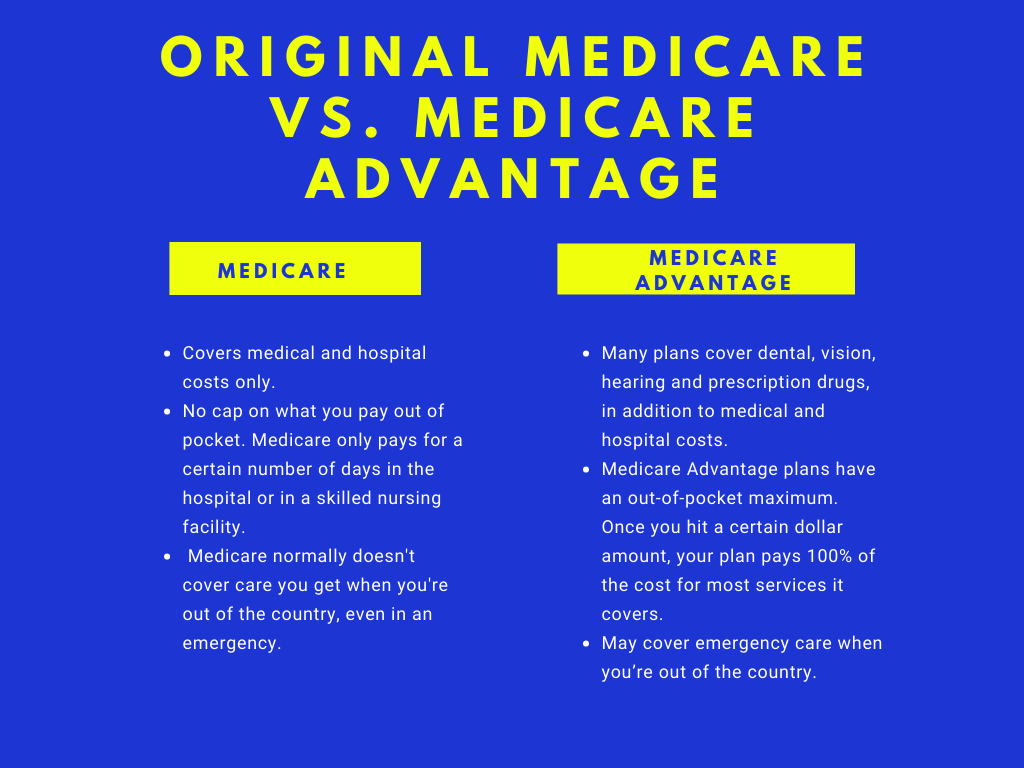

Medicare doesn't cover prescription drugs (except in very limited circumstances), dental or hearing care or cosmetic procedures. Long-term care or custodial care received in your home are also not covered.

There are four parts to Medicare.

- Part A- Medicare Part A covers hospital care. You are protected during short-term stays in hospitals and for services like Hospice. You also get limited coverage for some in-home healthcare services and skilled nursing facility care.

- Medicare Part B- Medicare Part B covers doctor's appointments, urgent care visits, preventative care, and medical equipment.

- Part C- Medicare Part C is also known as Medicare Advantage. These plans combine the coverage of Parts A, B, and Part D into a single plan. Private insurance companies offer Medicare Advantage plans that are overseen by Medicare.

- PDP or Medicare Part D- Medicare offers drug coverage through Part D, AKA PDP (Prescription Drug Plan). These are stand-alone plans that only cover your medications. Private insurance companies offer Part D plans, not the Federal Government.

What are Medicare Advantage Plans?

Medicare Advantage plans are also called Part C. They're an alternative to Original Medicare because they cover Parts A and B, and sometimes D.

Part C plans may also include Extra benefits that original Medicare doesn't cover. These could be benefits like prescription drug coverage, hearing, vision, dental, fitness programs, meals after surgery. Many Medicare Advantage Plans include more—some even offer assistance through "Part B give-back," which means they'll give you an offset that counts toward your Part B premium, meaning more money every month in your pocket!

Things to know about Medicare Advantage Plans

- You're still part of the Medicare program.

- Your Medicare rights and protections still exist.

- The plan provides complete coverage of Part A and Part B.

- Medicare Advantage Plans may have lower out-of-pocket costs. This option may be more economical for you.

- A Medigap plan is not needed, and you cannot buy it if you have a Medicare Advantage plan.

- You can only join a Medicare Advantage plan during certain times of the year.

- Even if you have a pre-existing condition, it is possible to join a Medicare Advantage Plan.

- Before you get a service, you can check with the plan to see if it's covered and what your costs may be.

- Getting a referral to see a specialist in the plan's network can help keep your costs lower.

- You must go to a doctor, other health care provider, facility, or supplier that belongs to the plan's network, so your services are covered, and your costs are less. This applies to Medicare Advantage HMOs and PPOs in most cases.

- During the year, providers can join or leave their networks. It is possible for your plan to change providers during the year. You might need a new provider if this happens.

- Your plan could cover some costs if you join a clinical research study. If you need more information, call the number on the back of your membership card.

- Medicare Advantage Plans are not allowed to charge more for certain services than original Medicare charges.

- There is a yearly limit on out-of-pocket costs for Medicare Advantage Plans. You won't pay anything for covered services once you reach this limit. Each plan can have a different out-of-pocket limit, and the limit can change each year. This is something you should think about when selecting a plan.

- You'll have to join another plan if the plan stops participating in Medicare.

What is the difference between Medicare and Medicare advantage?

Some other differences between Medicare and Medicare advantage are:

You pay 20 percent of the cost, or 20 percent coinsurance, for everyday health services with Original Medicare. Copays are used instead of coinsurance for these services in most Medicare Advantage plans. This means you pay a fixed cost.

For example, your Medicare Advantage plan might have a $10 copay when you see the doctor. No matter how much the visit costs your health insurance company, you will pay $10 every time. You'll pay 20% of the total cost if you have Original Medicare. You pay $40 if the visit is $200.

Network

You are able to go to any doctor or facility that accepts Medicare with original Medicare. Medicare Advantage plans have networks of doctors and hospitals. Your plan will have rules about whether or not you can get care outside your network. You'll pay more for the care you get outside your network with any plan. With some plans, you will have to pay 100% of the cost if you go out of network.

Need Help in Choosing the Right Coverage for You?

Picking the right coverage is essential. Understanding your Medicare coverage is critical. The agents and brokers at CertifedMedicareAgents.com are here to help you find a plan that suits your needs. Select one of the agents on this site and send a message today!