Part C: A Comprehensive Guide to How Medicare Advantage Works

Discover the untapped secrets of Medicare Advantage, empowering you with a comprehensive guide to unlock its incredible benefits.

Table of Contents

- What is Medicare Advantage?

- Eligibility Criteria for Medicare Advantage

- Types of Medicare Advantage Plans

- Understanding Costs and Coverage

- Enrollment Periods and Potential Pitfalls

- Conclusion

Welcome to our comprehensive guide on understanding how Medicare Advantage works! Medicare Advantage is an excellent option for seniors looking for comprehensive healthcare coverage while enjoying additional benefits. In this blog post, we will break down the intricacies of Medicare Advantage, providing you with a simplified yet comprehensive overview of how it works. From eligibility requirements to different plans and enrollment periods, we've got you covered!

What is Medicare Advantage?

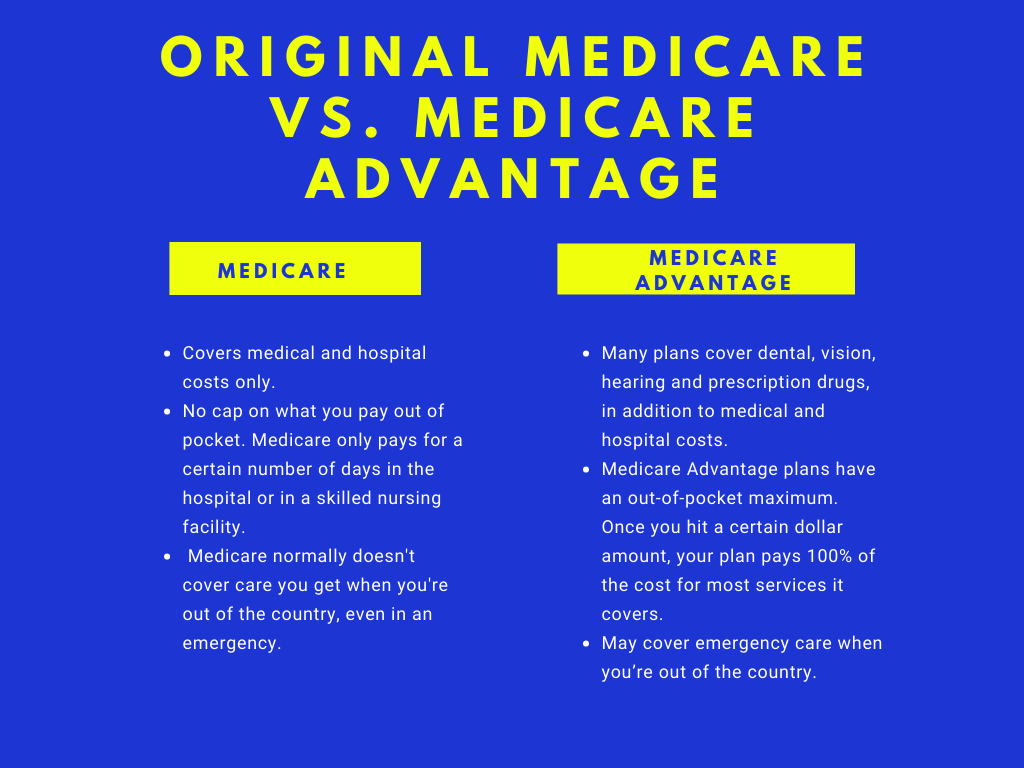

Medicare Advantage, also known as Medicare Part C, is a health insurance option offered by private insurance companies approved by Medicare. It combines the benefits of Original Medicare (Part A and Part B) into one plan, including hospital visits and medical services, while often offering additional coverage such as prescription drugs, dental, vision, and hearing.

Get Free Help from One of Our Member Agents |

Unlike Original Medicare, which is directly administered by the federal government, Medicare Advantage plans are provided by private insurance companies. These companies are contracted by Medicare and approved to offer this alternative way to receive Medicare benefits. It's important to note that while Medicare Advantage plans must cover all the same services as Original Medicare, specific details and costs may vary.

Eligibility Criteria for Medicare Advantage

To be eligible for Medicare Advantage, you must first be eligible for Medicare Part A and Part B. Generally, this means you are 65 years or older, a U.S. citizen, or a legal resident who has lived in the country for five consecutive years.

In addition to these basic requirements, you must also live within the service area of the Medicare Advantage plan you wish to join. Service areas can vary by plan, so it's important to check if your location falls within the specified region.

Furthermore, if you are eligible for both Medicare and Medicaid, commonly known as "dual-eligible beneficiaries," you may have additional options and benefits available to you. In this case, it's advised to research and understand the specific plans tailored for dual-eligible beneficiaries offered in your state.

"Discover the untapped potential of Medicare Advantage and unlock a world of health benefits for a fulfilling life. Harness the power of #MedicareAdvantage with this comprehensive guide: #Healthcare #ElderlyCare" |

Types of Medicare Advantage Plans

Medicare Advantage plans come in different types, each with its own features and strengths. Here are some common types of Medicare Advantage plans:

Health Maintenance Organizations (HMOs)

HMO plans typically require you to choose doctors and healthcare providers within a network. You'll usually need a referral from your primary care physician to see specialists, and out-of-network coverage is generally limited.

Preferred Provider Organizations (PPOs)

PPO plans allow you to visit any healthcare provider within or outside the plan's network, although you may incur higher out-of-pocket costs when going out-of-network. Referrals are not required to see specialists.

Special Needs Plans (SNPs)

SNPs are tailored to individuals with specific health conditions, such as chronic illnesses or certain disabilities. These plans focus on providing specialized care for the targeted group, with doctors and healthcare providers who specialize in the conditions covered.

Consider your healthcare needs, preferred doctor, and access to healthcare providers when choosing the right type of plan for you.

Understanding Costs and Coverage

When considering Medicare Advantage plans, it's essential to understand the costs involved and the coverage they offer. Costs and coverage can vary depending on the plan you choose, so it's crucial to review the plan details before making a decision.

Here are some cost-related aspects to keep in mind:

Premiums

Medicare Advantage plans may have a monthly premium on top of the Part B premium paid to Medicare. However, some plans have a $0 premium, so be sure to compare different plans to find one that suits your budget.

Deductibles and Copayments

Like Original Medicare, Medicare Advantage plans often include deductibles and copayments for services. These vary between plans and may be different for in-network and out-of-network services. It's important to review these costs to ensure they align with your healthcare needs.

Additional Benefits

One of the significant advantages of Medicare Advantage plans is the potential for additional benefits beyond what Original Medicare offers. These can include coverage for prescription drugs, dental care, vision exams, hearing aids, fitness programs, and more. Review the additional benefits offered by each plan to see if they align with your specific needs.

Out-of-Pocket Maximum

Medicare Advantage plans have an annual out-of-pocket maximum. Once you reach this limit in a calendar year, the plan covers 100% of covered services for the remainder of that year. This provides financial protection and helps prevent excessive healthcare costs.

Enrollment Periods and Potential Pitfalls

Understanding the enrollment periods and avoiding potential pitfalls is crucial when it comes to Medicare Advantage. Here are some key points to keep in mind:

Initial Enrollment Period (IEP)

Your initial enrollment period for Medicare Advantage typically starts three months before your 65th birthday and includes the month you turn 65, as well as the three months following. It's important to enroll during this period to avoid potential penalties and gaps in coverage.

Annual Enrollment Period (AEP)

The Annual Enrollment Period, also known as the Fall Open Enrollment Period, runs from October 15th to December 7th each year. During this time, you can switch Medicare Advantage plans, switch from Original Medicare to Medicare Advantage, or vice versa. It's an opportunity to review your current plan, compare alternatives, and make changes for the following year.

Special Enrollment Periods (SEPs)

Certain life events may qualify you for a Special Enrollment Period, allowing you to make changes to your Medicare Advantage plan outside of the regular enrollment periods. These events can include moving to a new coverage area, losing your current coverage, or qualifying for Extra Help with prescription drug costs.

Research and Compare

When considering Medicare Advantage plans, take your time to research and compare plans to find the one that best meets your healthcare needs. Look at the network of doctors and healthcare providers, coverage for prescription drugs and other needs, estimated costs, and overall customer satisfaction ratings.

Make sure you understand the potential pitfalls of missing enrollment deadlines and the implications of plan changes. It's crucial to plan ahead and make informed decisions to ensure uninterrupted coverage and avoid disruptions in your healthcare.

Discover the Power of Medicare Advantage with free help from a Certified Medicare Agent |

Conclusion

Medicare Advantage can be a game-changer when it comes to comprehensive healthcare coverage for seniors. By understanding the fundamental aspects of how Medicare Advantage works, such as eligibility criteria, plan types, costs, coverage, and enrollment periods, you can confidently navigate the Medicare landscape and make informed choices that align with your healthcare needs and preferences.

Take advantage of the benefits that Medicare Advantage offers and explore the available options to find a plan that provides the coverage you need along with any additional benefits that suit your lifestyle. Unleash the potential of Medicare Advantage and ensure peace of mind as you embark on this important aspect of your healthcare journey!