Navigating the complex world of Medicare can be overwhelming, especially for seniors and caregivers in Detroit. Trying to understand insurance plans, coverage options, copays, and deductibles can leave many feeling lost and confused. The good news is that with a little guidance and education, you can make informed decisions about your healthcare needs. In this comprehensive guide to Medicare in Detroit, we will explore the ins and outs of the program so that you have a clearer picture of what it offers and how you can benefit from it. Our aim is to make sure that all seniors in Detroit feel confident in their choices when it comes to their healthcare coverage. So sit back, relax, and let's demystify Medicare together!

Understanding the Basics of Medicare: Parts A, B, C, and D

When it comes to understanding Medicare, it's important to start with the basics. There are four parts to Medicare: Parts A, B, C, and D. Each part covers different services and has its own costs and eligibility requirements.

Part A is often referred to as hospital insurance.

It helps cover inpatient care in hospitals or skilled nursing facilities. For most people, Part A is free because you paid for it with your taxes while you were working. As of 2024, Part A has a deductible of $1,632 that covers the first 60 days in the hospital. This is a per-occurrence deductible, not an annual deductible, so you could wind up paying it more than once in a calendar year.

After the first 60 days, you'll have to pay a copay depending on how long you've stayed:

Days 60-90 are $408 per day

Days 91-150, you'll use your Lifetime Reserve Days. These days can only be used once in your life, and as of 2024 you'll pay $816 per day.

After your Lifetime Reserve Days are gone, you'll pay 1000% of the costs unless you have additional insurance to cover those costs.

Part B covers providers:

Part B covers medical services such as doctor visits, lab tests, outpatient procedures, and preventive screenings. It also covers certain medications (such as the ones your doctor administers) and chemotherapy.

To enroll in Parts A and B, you must be 65 years of age or older or have certain disabilities.

In Detroit, Part C is also known as Medicare Advantage.

A Medicare Advantage plan is a private insurance plan (run by an insurance company) that combines the benefits of Parts A and B. These plans also usually have additional coverage options like dental or vision services. Private insurance companies approved by Medicare offer Medicare Advantage.

Part D is prescription drug coverage for those enrolled in Original Medicare (Parts A or B) or is included in a Medicare Advantage plan.

Understanding these basic components of Medicare can help people make informed decisions about their healthcare needs while also easing the confusion associated with navigating this complex system. Our goal is to ensure that you feel comfortable accessing healthcare resources when needed so you can live a healthy life without the worry of financial burdens weighing you down.

Eligibility Requirements for Medicare in Detroit

To be eligible for Medicare in Detroit, you must meet certain requirements.

First and foremost, you must generally be 65 years or older to qualify for Medicare Part A or B. But if you're under 65 and have a qualifying disability or end-stage renal disease, you may also be eligible for benefits. Secondly, it is important to note that if you are already receiving Social Security benefits when you turn 65, you will automatically be enrolled in both Medicare Parts A and B. However, if this isn't the case for everyone who turns 65 in Detroit; some will need to sign up during the designated enrollment period.

Lastly, depending on your income level, some beneficiaries may qualify for extra help with their prescription drug costs through the Medicare Savings Program (MSP), which includes Medicaid programs such as MI Bridges. Overall eligibility requirements can feel complicated, so we recommend speaking with a Medicare specialist to determine your specific situation's code-based decision-making process with ease.

Enrollment Periods: When and How to Sign Up for Medicare

One important aspect of Medicare is understanding enrollment periods. The initial enrollment period begins three months before your 65th birthday and ends three months after (unless your birthday is the 1st of the month, in which case everything gets moved up a month).

It's crucial to sign up for Medicare during this time, as missing the deadline could result in penalties or gaps in coverage. If you miss the initial enrollment period, don't worry; there might be other opportunities to enroll during the general enrollment period or special enrollment periods.

To enroll in Medicare, you can visit the Social Security website, call their toll-free number, or visit a local Social Security office. You will need personal information such as your social security number, birth date, and employment history when applying for coverage. Once enrolled in Original Medicare (Part A and Part B), additional coverage options like Medicare Supplement Plans or Part C may be available to you.

You can also sign up for a drug plan when you have either Part A or Part B.

Understandably, navigating through these processes can seem daunting at first glance but rest assured that help is available from Michigan Medicare experts with years of experience dealing with this program. Their aim is to ensure all seniors feel comfortable making informed decisions about their healthcare needs. So if you ever have any questions along the way, do not hesitate to reach out for assistance!

Medicare Coverage for Preventive Services and Screenings

As a senior or caregiver in Detroit, it's important to know that Medicare provides coverage for preventive services and screenings. These services are designed to help detect health problems early on before they become more serious and expensive to treat. Some of the preventive services covered by Medicare include mammograms, colonoscopies, shingles shots, flu shots, hepatitis B shots, diabetes screenings, and cardiovascular disease screenings. The great thing about these preventive services is that they are usually provided at no cost to you. That means no copayments or deductibles for these essential health checks. However, it's important to understand which preventive services are covered under your specific plan and how often you can receive them. If you're unsure about your coverage or have questions about qualifying for certain preventive care options under Medicare, you can look it up at https://www.medicare.gov/coverage/is-your-test-item-or-service-covered.

Understanding Medicare Costs: Premiums, Deductibles, and Copays

Medicare, the federal health insurance program for people who are 65 and older or those with certain disabilities, can provide critical healthcare coverage for Detroit seniors. However, navigating Medicare costs can be confusing. The three main categories of charges are premiums, deductibles, and copays.

Premiums refer to the monthly amount you pay to participate in Medicare. Most beneficiaries do not pay a premium for Part A (hospital insurance) because they have worked long enough to qualify for Social Security benefits. However, there is a premium attached to Part B (doctors' visits and outpatient care), which varies based on income level. Most people in 2023 will pay $164.90 per month, but some will pay more. Take a look at the chart below to see what your payments will be.

Deductibles are the amounts you must pay before Medicare begins covering your medical expenses.

For example, as mentioned earlier, under Part A hospital insurance in 2024, if you're admitted as an inpatient and stay less than 60 days, then you'll owe a $1,632 deductible for each benefit period cycle; after that period expires, you must re-enter another benefit period by spending out-of-hospital services at a new deductible period.

After your deductible, then the daily copays apply.

For Part B, as of 2024 the deductible $240 in and then after that, Medicare covers 80% and your portion is 20%.

Skilled nursing is also covered, assuming you've been an inpatient in the hospital for a minimum of three days. If you have, then Medicare covers the first 20 days at 100%. For days 21-100, there is a copay of $204 per day. Medicare does not pay anything starting on the 101st day.

Understanding these costs will help ensure seniors and caregivers in Detroit select plans that best fit their needs without overwhelming them with financial obligations along the way.

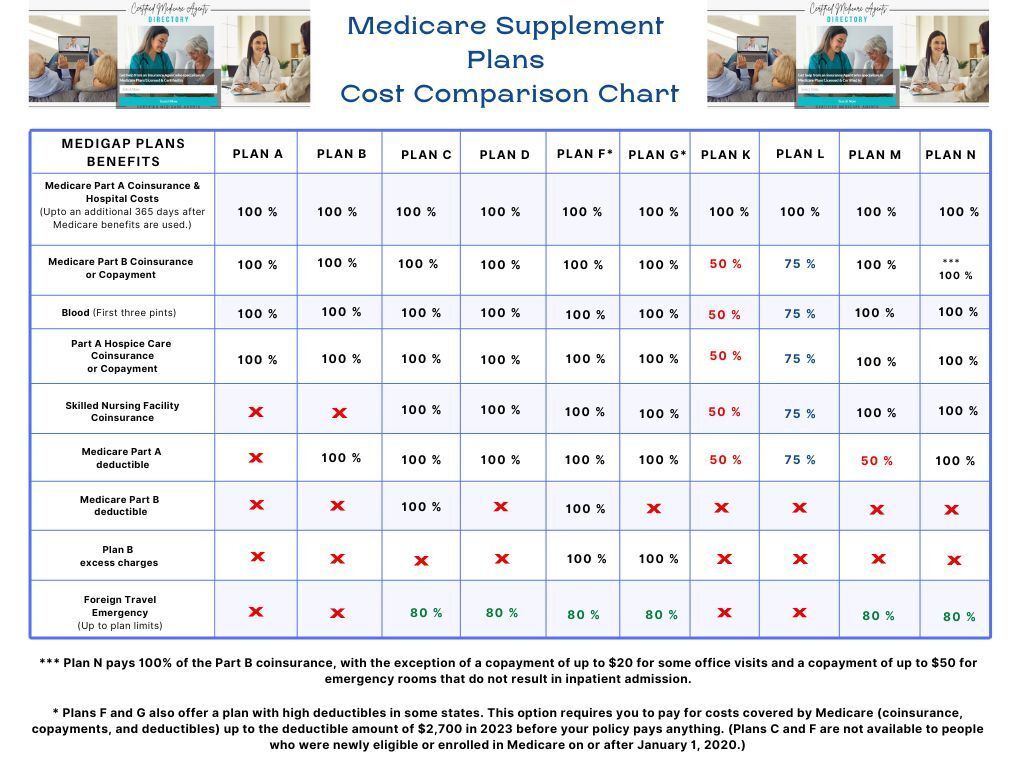

Medigap Policies: Supplementing Your Medicare Coverage

Medigap policies (Also known as Medicare Supplement Plans) can play a crucial role in supplementing your Medicare coverage. Medigap policies cover the deductibles, copays, and coinsurance amounts of original Medicare. They come in various plans that offer different levels of coverage to fill the gaps left by Original Medicare. Depending on your particular medical needs and budget, you may find a Medigap policy that fits perfectly with your existing plan.

It is important to note that Medigap policies do not provide standalone coverage; they work together with Original Medicare. If you're a senior or caregiver navigating through the complex world of healthcare in Detroit, consider adding a Medigap policy to your arsenal of health insurance options. By doing so, you'll be taking proactive steps towards ensuring comprehensive coverage and peace of mind for all your healthcare needs.

Medicare Advantage Plans: What They Are and How They Work

Medicare Advantage Plans are a type of Medicare program which private insurance companies offer. The plans, also known as Part C, must provide at least the same amount of coverage as Original Medicare (Part A and B) but can include additional benefits like prescription drug coverage, vision and dental care, wellness programs, and hearing aids. In other words, it's an all-in-one alternative to original Medicare run by a private insurance company.

To enroll in a Medicare Advantage Plan, you must first be enrolled in both Parts A and B of original Medicare. This means that you must also pay the premium for Part B. Each plan has its own set of rules regarding costs, such as healthcare provider networks or copayments for doctor visits or medications. Hence, it is important to research the specific plan's details when considering signing up.

The idea behind these types of plans is to give beneficiaries more choices in their healthcare options while maintaining equal or better benefits than traditional Medicare. It is important that seniors in Detroit understand what advantages they hold with these plans. There might be extra hoops to jump through or extra costs if enrolled incorrectly without careful consideration. Knowing about your options beforehand will ultimately help you make informed decisions about your health needs by taking full advantage of what this program provides – giving seniors reassurance that they're getting the higher quality care they can rely on.

Prescription Drug Coverage: Exploring Medicare Part D

Prescription drug coverage is an essential aspect of healthcare that seniors in Detroit must understand before enrolling in Medicare. This coverage, also known as Medicare Part D, focuses on providing affordable and accessible prescription drugs to beneficiaries. The program is designed to help those struggling with medication costs get the treatment they need without facing financial difficulties. One thing to keep in mind is that not all medications are covered under each plan. These plans are run by private insurance companies. It's important for seniors and caregivers to research specific prescriptions online or speak with both their doctor and pharmacist about which ones are included since medical conditions can vary greatly from patient to patient.

Navigating the complexities of prescription drug coverage on top of typical healthcare expenses can be overwhelming. That's why taking advantage of resources available-- like education classes through local organizations or via Medicare insurance brokers --can make a huge difference when it comes to enrolling in Medicare Part D plan options, finding supplemental insurance, or understanding how copays work. By working together, we hope we can ensure seniors feel empowered rather than lost in navigating the world of Medicare!

Common Medicare Mistakes to Avoid in Detroit

When it comes to Medicare in Detroit, there are some common mistakes that seniors and caregivers should be aware of. One mistake is not understanding the enrollment process. It's important to enroll during your initial enrollment period to avoid late penalties or gaps in coverage. Another mistake is assuming that Medicare covers all healthcare costs – there may be copays, deductibles, and limits that need to be considered. Also, many people think that Medicare covers Long Term Care expenses, and it does not. Additionally, many seniors make the mistake of not reviewing their coverage options every year during open enrollment. Your healthcare needs can change each year, so it's important to evaluate your plan annually and make changes if necessary. Finally, relying solely on a referral from a physician for medical services can also be a mistake, as Medicare may not cover some services or may have different requirements.

Overall, avoiding these common mistakes through education and guidance can help ensure that seniors in Detroit receive the best possible healthcare while maximizing their benefits under Medicare.

Resources for Seniors in Detroit: Getting Help with Medicare

As seniors in Detroit navigate the complexities of Medicare, it can be helpful to know that there are resources available to help them. Many organizations offer free or low-cost assistance with enrollment, plan selection, and understanding coverage options. One such organization is the Michigan Medicare/Medicaid Assistance Program (MMAP), which provides one-on-one counseling services for seniors who need help navigating the system.

In addition to MMAP, many local senior centers and community organizations in Detroit also offer information and support for those dealing with Medicare questions or concerns. The Area Agency on Aging is another valuable resource for seniors seeking guidance about their Medicare benefits. This agency partners with local nonprofits and other groups to provide a range of services aimed at improving the quality of life for older adults.

Of course, there are Medicare insurance brokers who can help, and you can find them by searching our member agents at CertifiedMedicareAgents.com.

Overall, whether you're approaching eligibility age or already enrolled in the program, getting help with your Medicare benefits can make a big difference in your overall healthcare experience as a senior living in Detroit. So don't hesitate to explore these available resources – they're designed specifically to benefit you!