Maximizing Your Health Benefits: A Guide to Medicare in Tucson

As we age, our healthcare needs increase, and it becomes crucial to have a proper healthcare plan to provide us with the care we need. Medicare is an essential source of health insurance for seniors in Tucson, but navigating the complex system can be overwhelming. This guide has been created to help you maximize your health benefits through Medicare in Tucson. At its core, this article is all about compassion, compassion towards those struggling to make sense of their healthcare plans, and those who want more information on how to take control of their health. It's also about offering hope that amidst all the confusion, answers are waiting for those who seek them out - answers that might make a world of difference when it comes to improving your quality of life as you age.

Understanding the Basics of Medicare in Tucson

Understanding the basics of Medicare in Tucson can be daunting, particularly for seniors who might not have a firm grasp on health insurance. That's why it's so important to approach the topic with compassion and understanding, recognizing that navigating this complex system can sometimes be challenging. By learning about how Medicare works and what benefits are available, seniors can take control of their healthcare plans and ensure they're getting the care they need.

One key thing to understand is that there are different parts of Medicare, each covering specific services or types of care. For example, Part A covers hospital stays, while Part B covers outpatient care like doctor visits or physical therapy.

We will discuss Part C (also known as Medicare Advantage) below.

Part D covers prescription drugs.

Maximizing your health benefits through these various programs requires careful consideration and understanding their rules and requirements. With some education and support, however, you'll find that Medicare offers plenty of options for maintaining your health as you age in Tucson.

Eligibility for Medicare in Tucson: Who Qualifies

If you're a resident of Tucson who is 65 years or older, you are likely eligible for Medicare benefits. Individuals with specific disabilities and those with end-stage renal disease may also qualify for this healthcare program. Eligibility requirements can be complex, but there are a few essential criteria to remember. Firstly, you must have worked and paid taxes towards Medicare during your employment period to qualify. If you still need to, you may still be able to enroll by paying a premium fee. Secondly, those seeking coverage must be US citizens or permanent residents who have legally resided in the country for at least five years.

Navigating the application process may seem daunting at first glance — but remember that help is available! The staff at your local Social Security office can assist in enrolling you into Medicare A and B. Our member Medicare brokers can help you enroll in a Medigap or Medicare Advantage plan that best suits your healthcare needs and financial situation. Take advantage of the resources around you to maximize your health benefits through Medicare here in Tucson.

The Different Parts of Medicare: What They Cover

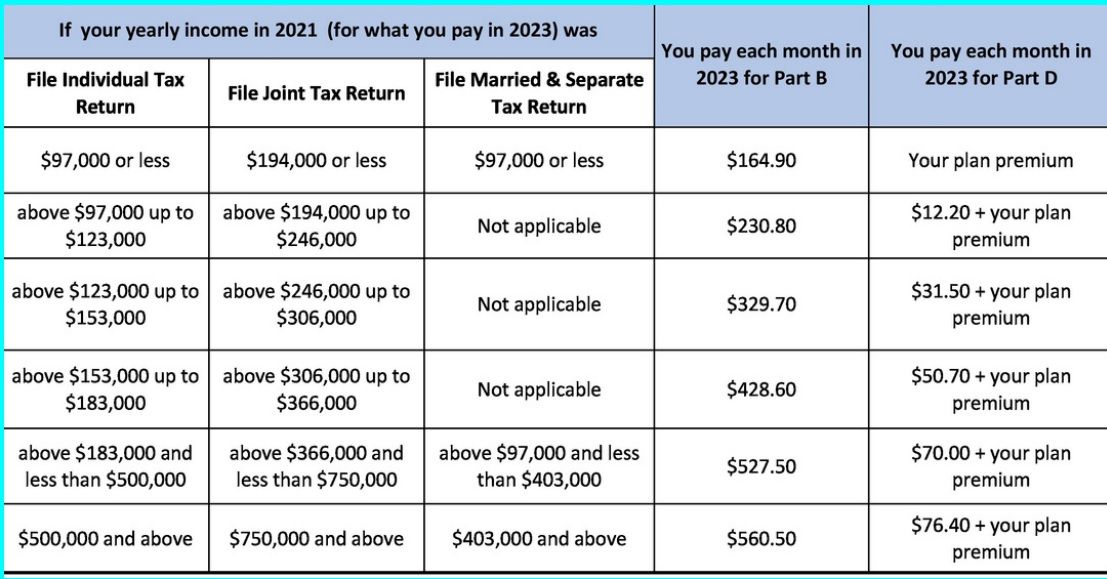

Medicare is made up of various parts, each designed to cover different types of healthcare services. Part A covers hospital stays, hospice care, and skilled nursing facilities. Part A is free if you've worked 40 quarters and paid into the system. Part B covers doctor visits, outpatient care, preventative services like screenings, and medical equipment such as wheelchairs or oxygen tanks. This Part requires a monthly premium payment based on income level (see the chart below):

Part D provides prescription drug coverage through private insurance companies approved by Medicare. It also requires a monthly premium payment based on income level but can help significantly reduce out-of-pocket costs for medications not covered under other parts of Medicare.

Understanding the different parts of Medicare and what they cover is essential in maximizing health benefits for Tucson seniors with unique healthcare needs that change as they age. Knowing which Part (s) are needed will ensure access to quality healthcare without additional out-of-pocket expenses.

Maximizing Your Benefits through Medicare Supplement Plans in Tucson

Maximizing your benefits through Medicare Supplement Plans in Tucson can be a lifesaver for seniors facing mounting healthcare costs.

These plans generally do not provide additional coverage to Medicare, but they pay the copays and deductibles of Medicare. The main advantage of these plans is that you retain your original or traditional Medicare. Original Medicare does not require "pre-authorization" for most services. Additionally, Traditional Medicare does not have networks, so as long as the doctor accepts Medicare, they take your plan.

With the help of a qualified Medicare insurance agent or advisor, you can navigate the complex world of Medicare Supplements and find the right plan for your individual needs. By taking advantage of all available resources, such as preventative screenings, you can stay on top of your health and catch potential health issues early.

This proactive approach can save both money and stress down the road. Maximizing your benefits through supplemental plans helps ensure you receive quality healthcare while staying within budget constraints - creating peace of mind for yourself and your loved ones.

Exploring the Benefits of Medicare Advantage Plans in Tucson

Having a comprehensive healthcare plan becomes crucial as we age and become more prone to health issues. Medicare Advantage plans are becoming increasingly popular in Tucson due to their extensive benefits beyond what traditional Medicare offers. These plans provide beneficiaries with access to additional services such as vision care, hearing aids, gym memberships, and even transportation to medical appointments. One of the most significant advantages of enrolling in a Medicare Advantage plan is that all your healthcare needs are bundled into one convenient package. This means you don't have to worry about managing separate prescriptions or copays for different specialists. Your primary care physician will coordinate all your medical care within your chosen network of providers.

By understanding how these plans work and taking advantage of their benefits, seniors can significantly enhance their quality of life by getting the necessary preventive care and early interventions while reducing out-of-pocket expenses. With compassion as our driving force, this guide aims to empower seniors in Tucson towards better health outcomes by choosing the right Medicare Advantage Plan.

Special Needs Plans: Medicare for Those with Chronic Conditions or Medicaid

Special Needs Plans (SNPs) are a valuable Medicare option for individuals with chronic conditions. These Medicare Advantage type plans provide tailored benefits and care coordination to meet the specific needs of those who suffer from conditions such as dementia, heart failure, diabetes, or end-stage renal disease. SNPs have highly trained health providers who work with beneficiaries' primary care physicians to manage their complex medical requirements. The SNP program is designed around high-quality patient-centered care focusing on individualized attention. This level of specialization ensures that each beneficiary receives personalized treatment options, which can improve health outcomes and enhance overall well-being. It's important to understand that not all SNPs offer similar benefits, so choosing the right plan can be crucial for achieving better healthcare results. Duo SNPs are tailored for those people who are on Medicaid.

In conclusion, Special Needs Plans are crucial for beneficiaries who require extra assistance and resources due to the complications associated with Medicaid Eligibility, chronic illnesses, or debilitating injuries. Choosing an appropriate plan requires careful research and weighing out various options since different SNPs offer unique specialized services based on differing parts of enrollees' healthcare coverage criteria. Additionally, they might tailor the plan to expected living situations relating specifically to their disabilities within Medicare provisions available in Tucson. But ultimately, promoting compassionate approaches can result in access to more efficient and effective healthcare delivery. The SNP plans support targeted populations regardless of any barriers experienced by preexisting issues.

Understanding the Enrollment Periods for Medicare in Tucson

Understanding the enrollment periods for Medicare in Tucson is essential to ensure that you have appropriate health coverage.

The Initial Enrollment Period (IEP) starts three months before your 65th birthday and lasts seven months. If your birthday falls on the first of the month, everything moves back a month. You may face a late penalty fee if you miss this enrollment period. However, if you are still working or receiving coverage from an employer at age 65, you can enroll during the Special Enrollment Period without any penalties.

The Annual Election/Enrollment Period (AEP) is when you can change, enroll, or drop Medicare Advantage and Drug Plans. This happens every year from 10/15 through 12/7.

Medicare Advantage Open Enrollment Period only applies to those with a Medicare Advantage Plan. During this time, you can make one change to your Medicare Advantage Plan or drop it altogether. This enrollment period is from 12/1 through 3/31 of every year.

These enrollment periods do not apply to Medigap Plans. If you do not enroll in a Medigap plan during a Guaranteed Issue period, the insurance company can refuse to cover you.

Understanding the various Medicare enrollment periods available in Tucson can help seniors improve their overall quality of life by ensuring they get effective healthcare when they most need it. Learning about these options sooner than later could pay dividends down the line. Those who wait too long might end up paying more money out-of-pocket unnecessarily due to missed deadlines or mistakes made in enrolling into programs that do not fit their needs effectively enough over time.

Common Mistakes to Avoid When Using Medicare in Tucson

When it comes to using Medicare in Tucson, there are several common mistakes that seniors tend to make. One of the biggest mistakes is needing to understand what's covered by their plan. Beneficiaries must review their benefits and understand what services and treatments are covered under each Part of Medicare. For instance, routine dental care, eyeglasses, or hearing aids are not included in traditional Medicare. But Medicare Advantage Plans (that might include these items) use pre-authorization to save money. Another mistake to avoid when using Medicare in Tucson involves failing to compare options during enrollment periods. Every year during the AEP, beneficiaries can switch from one Medicare Advantage plan type to another. However, some people renew their existing coverage without exploring other options that might provide better value.

Finally, seniors who delay signing up for Medicare can also make a costly mistake since they may face late penalties or gaps in coverage as they enroll later than they should've at age 65 (unless they are still working with employer-provided insurance coverage.). To maximize Medicare health benefits throughout retirement years, start early & review updated information yearly!

Resources for Assistance: Where to Find Help in Tucson

As we age, healthcare becomes a critical part of our lives. It's all about ensuring you get the care you need and deserve, but Medicare plans can be extremely daunting to navigate alone. That's why Tucson offers an abundant range of resources for seniors who are seeking support and assistance with managing their health benefits. Many local organizations guide how to enroll in Medicare and offer information on various plan options. They're also there to answer questions about your coverage, premiums, deductibles, or other details specific to your situation. Additionally, senior community centers serve as an excellent resource where older adults can find health education classes and activities that promote better mental & physical health.

Most importantly, you can find a licensed Medicare Agent by searching our directory.